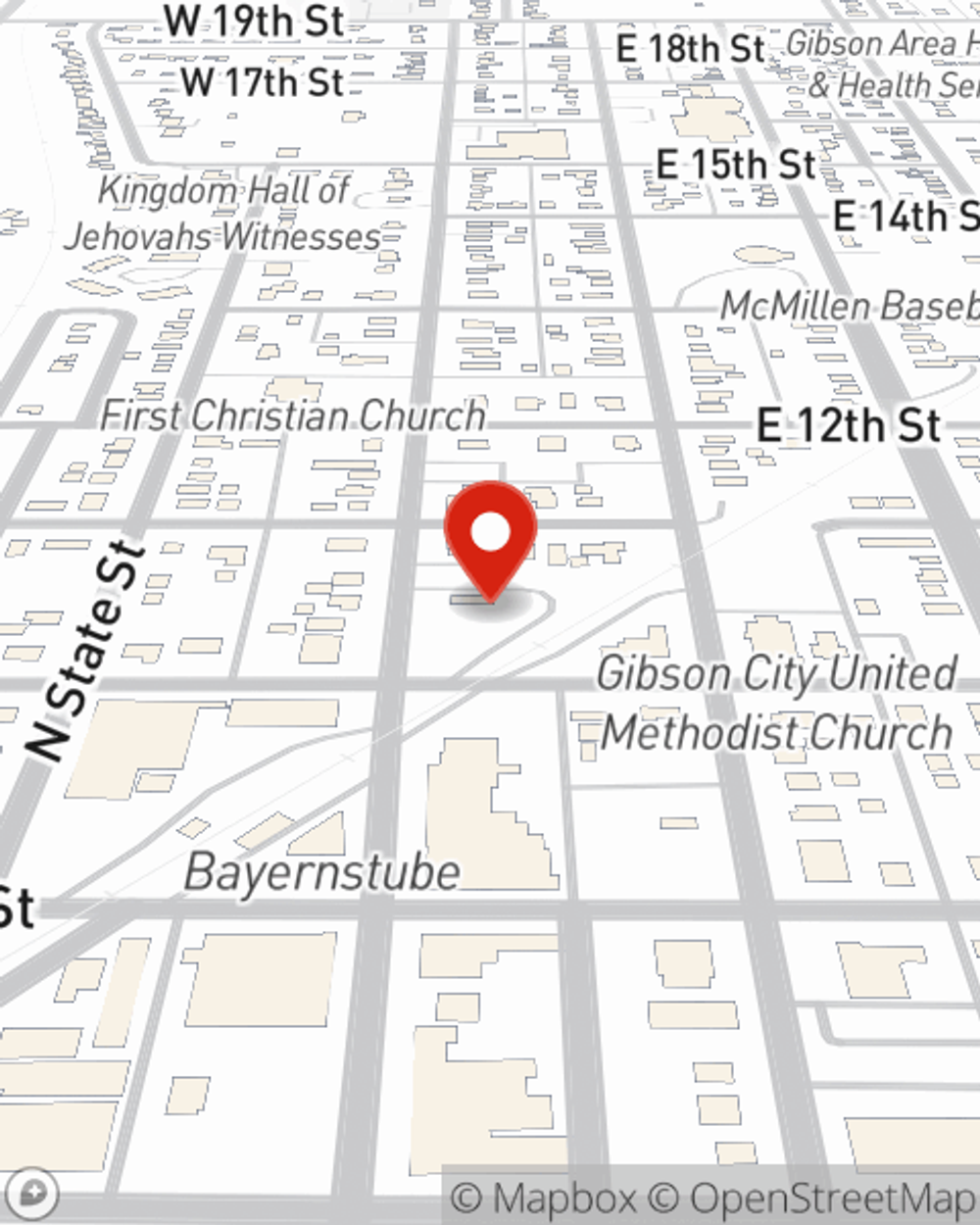

Condo Insurance in and around Gibson City

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

- Gibson City

- Farmer City

Condo Sweet Condo Starts With State Farm

As with any home, it's a good idea to make sure you have coverage for your condominium. State Farm's Condo Unitowners Insurance has terrific coverage options to fit your needs.

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

Why Condo Owners In Gibson City Choose State Farm

Things do happen. Whether damage from freezing pipes, theft, or other causes, State Farm has fantastic options to help you protect your condominium and personal property inside against unanticipated circumstances. Agent Greg Kurtenbach would love to help you create a policy that is personalized to your needs.

Getting started on an insurance policy for your condo is just a quote away. Call or email State Farm agent Greg Kurtenbach's office to discover your options.

Have More Questions About Condo Unitowners Insurance?

Call Greg at (217) 784-8343 or visit our FAQ page.

Simple Insights®

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Greg Kurtenbach

State Farm® Insurance AgentSimple Insights®

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.