Life Insurance in and around Gibson City

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Would you like to create a personalized life quote?

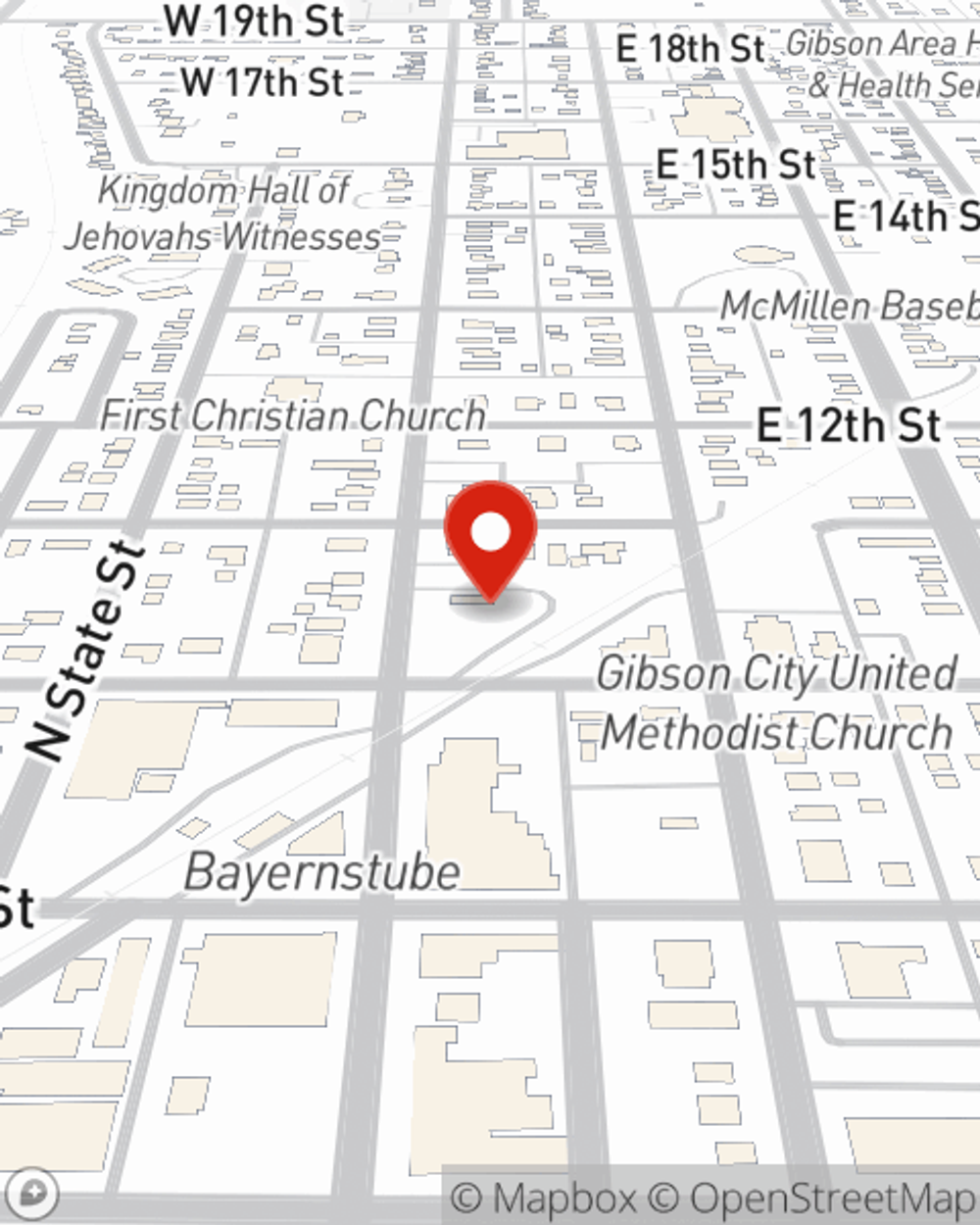

- Gibson City

- Farmer City

Your Life Insurance Search Is Over

People sign up for life insurance for many different reasons, but the purpose is many times the same: to ensure a certain financial future for your partner after your passing.

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Life Insurance You Can Trust

Personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the unexpected happens, Greg Kurtenbach is waiting to help process the death benefit with care and consideration. State Farm has you and your loved ones covered.

It's never a bad idea to make sure your loved ones have coverage against the unexpected. Call or email Greg Kurtenbach's office to find out State Farm's Life insurance options.

Have More Questions About Life Insurance?

Call Greg at (217) 784-8343 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.

Greg Kurtenbach

State Farm® Insurance AgentSimple Insights®

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.